Sustainability

Corporate Governance

Ⅱ.Corporate Governance Systems

Business Management Organization and Other Corporate Governance Systems regarding Decision-making, Execution of Business, and Oversight

1. Organizational Composition and Operation

- Corporate Governance System

- Company with Audit and Supervisory Committee

Directors

- Number of Directors Stipulated in Articles of Incorporation

- 13

- Directors' Terms of Office Stipulated in Articles of Incorporation

- One year

- Chairperson of the Board

- President

- Number of Directors

- 8

- Election of Outside Directors

- Elected

- Number of Outside Directors

- 4

- Number of Independent Directors

- 3

Outside Directors' Relationships with the Company (1)

| Name | Attributes | Relationship with the Company* | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| a | b | c | d | e | f | g | h | i | j | k | ||

| Kazutoshi Sato | From other company | |||||||||||

| Haruo Sasaki | CPA | |||||||||||

| Katsutoshi Fukami | From other company | △ | ||||||||||

| Kazuya Shimamura | Lawyer | |||||||||||

Flick to view the entire table.

- *Categories for "Relationship with the Company"

- *○: The director presently falls under or has recently fallen under this category. △: The director fell under this category in the past.

- *●: A close relative of the director presently falls under or has recently fallen under this category. ▲: A close relative of the director fell under the category in the past.

- a.Person who executes business for the Company or its subsidiary

- b.Person who executes business for a non-executive director of the Company's parent company

- c.Person who executes business for a fellow subsidiary

- d.Person or entity for whom the Company is a major client or a person who executes business for said person or entity

- e.Major client of the Company or a person who executes business for said client

- f.Consultant, accounting expert or legal expert who receives large amounts of cash or other assets from the Company in addition to remuneration as a director/company auditor

- g.Major shareholder of the Company (in cases where the shareholder is a corporation, a person who executes business for the corporation)

- h.Person who executes business (him/herself only) for a client of the Company (excluding persons categorized as any of d, e, or f above)

- i.Person who executes business (him/herself only) for another company that holds cross-directorships/cross-auditorships with the Company

- j.Person who executes business (him/herself only) for an entity receiving donations from the Company

- k.Other

Outside Directors' Relationships with the Company (2)

| Name | Audit and Supervisory Committee Membership | Designation as Independent Director | Supplementary Explanation of the Relationship | Reasons for Appointment |

|---|---|---|---|---|

| Kazutoshi Sato | ○ | ○ | – | Mr. Sato has experience in serving as a director. The Company has appointed him as an outside director and member of the Audit and Supervisory Committee with the expectation that he uses his experience and knowledge to strengthen the audit system of the Company. The Company has also designated him as an independent officer as there is no risk of any conflicts of interest with general shareholders given the fact that there is no special interest between him and the Company. |

| Haruo Sasaki | ○ | ○ | – | Mr. Sasaki is a certified public accountant and tax accountant. The Company has appointed him as an outside director and member of the Audit and Supervisory Committee with the expectation that he reflects his ample business experience and expertise in finance and accounting in the audits of the Company. The Company has also designated him as an independent officer as there is no risk of any conflicts of interest with general shareholders given the fact that there is no special interest between him and the Company. |

| Katsutoshi Fukami | ○ | Mr. Fukami worked for Tokyo Small and Medium Business Investment & Consultation Co., Ltd., a major shareholder of the Company, as an executive n the past (until nine years ago) and currently serves as a corporate auditor of the company. There is no commercial relationship between the company and the Company, and there is no special interest between Mr. Fukami and the Company. | Mr. Fukami has excellent insight and experience as a senior management executive and corporate auditor. The Company has appointed him as an outside director and member of the Audit and Supervisory Committee with the expectation that he uses his insight and experience to strengthen the audit system of the Company. | |

| Kazuya Shimamura | ○ | ○ | – | Mr. Shimamura has expert knowledge, experience, etc., as a lawyer and a certified public accountant. The Company has appointed him as an outside director and member of the Audit and Supervisory Committee with the expectation that he provides useful advice mainly from the perspective of compliance. The Company has also designated him as an independent officer as there is no risk of any conflicts of interest with general shareholders given the fact that there is no special interest between him and the Company. |

Audit and Supervisory Committee

Composition of the Audit and Supervisory Committee and Attributes of the Chairperson

| All Committee Members | Full-time Members | Inside Directors | Outside Directors | Committee Chair | |

|---|---|---|---|---|---|

| Audit and Supervisory Committee | 4 | 1 | 0 | 4 | Outside Directors |

Flick to view the entire table.

- Directors and employees responsible for Audit and Supervisory Committee supporting duties

- None

Reasons for the Adoption of the Current System

Although the Company has not assigned any assistant employees to the Audit and Supervisory Committee, the Committee has been able to obtain necessary information appropriately and on a timely basis by strengthening coordination with executive directors, other employees, and the internal audit department, meaning that a system to ensure effective audits has been established. If such employees are assigned, any personnel change or evaluation of them is subject to the prior consent of the Audit and Supervisory Committee. In addition, such employees are not under the direction and order of the directors (excluding directors who are Audit and Supervisory Committee members) in executing their duties based on the audit instructions of the Audit and Supervisory Committee.

Cooperation among the Audit and Supervisory Committee, Accounting Auditors, and Internal Audit Department

The Audit and Supervisory Committee closely coordinates with the Audit Office to receive reports on the process and results of internal audits and investigations and to exchange opinions. The Audit and Supervisory Committee also closely coordinates with accounting auditors in order to improve the effectiveness of accounting audits by exchanging information and opinions with them on the status of business execution by the Company and the challenges therein, financial reporting risks, accounting treatment issues, etc., at the time of quarterly reviews and year-end audits.

Voluntarily Established Committee

- Voluntarily Established Committee Equivalent to the Nomination Committee or Remuneration Committee

- None

Matters concerning Independent Directors

- Number of Independent Directors

- 3

Other Matters Concerning Independent Directors

Incentives

- Implementation Status of Measures Related to Incentives Granted to Directors

- Introduction of a Performance-Linked Remuneration Plan and Other Measures

Supplementary Explanation for Applicable Items

I. Outline of performance-linked remuneration

The Company has adopted consolidated net sales and profit attributable to owners of parent as indicators underlying the performance-linked remuneration for directors for the purpose of raising their motivation to contribute to the improvement of the Group's financial performance. The total amount of performance-linked remuneration changes in accordance with changes in profit attributable to owners of parent. Only those directors who fall under "executive officers" as defined in Article 34, paragraph (1), item (iii) of the Corporation Tax Act are eligible for such remuneration. Directors who are Audit and Supervisory Committee members and outside directors are not eligible.

Remuneration is paid after the amount is determined in accordance with the calculation method described below:

A. Total amount of remuneration to be paid

The total amount of remuneration to be paid shall be the smaller of (i) the profit attributable to owners of parent multiplied by a ratio established by the Board of Directors at its meeting to be held during the current fiscal year (hereinafter, "Profit Distribution Ratio") and (ii) the annual maximum amount of variable portion (currently 20 million yen per year).

However, if consolidated net sales for the current fiscal year are not more than the consolidated net sales for the previous fiscal year, or if profit attributable to owners of parent is negative, the calculation above shall be performed as if profit attributable to owners of parent were zero.

Total amount of remuneration to be paid = Profit attributable to owners of parent × Profit Distribution Ratio (subject to the maximum amount of 20 million yen)

*Profit Distribution Ratio for FY2023 (41st term): 2.08%

B. Amount to be paid to each director

The amount to be paid to each director shall be determined by allocating to each director the total amount of remuneration to be paid (as calculated based on A. above) in accordance with the points calculated for each director by using the job responsibility index as determined by the Board of Directors (rounded down to the nearest thousand yen). However, the amount to be paid to each director shall be subject to the following upper limit:

<FY2023 (41st term) title points>

The sum of all title points is 7.66 (for one President, one Senior Managing Director (with Representative Authority), one Managing Director, and one Director).

Amount to be paid to each director = Total amount of remuneration to be paid for the current fiscal year × Title points/Sum of all title points for the current fiscal year

Upper limit of amount to be paid to each director:

President 7 million yen

Senior Managing Director 5 million yen

(with Representative Authority)

Managing Director 4 million yen

Director 3 million yen

C. Targets and results of indicators pertaining to performance-linked remuneration for the current fiscal year

For the current fiscal year, profit attributable to owners of parent and consolidated net sales, which are indicators that underlie performance-linked remuneration, were 517 million yen and 9,553 million yen, respectively. (The consolidated net sales target for the previous fiscal year was 9,231 million yen.)

II. Outline of the stock-acquisition type remuneration plan

For directors (excluding outside directors), the Company has introduced a stock-acquisition type remuneration plan for the purpose of further raising their motivation to contribute to long-term corporate value enhancement. Under this remuneration plan, a certain percentage of fixed remuneration amount is contributed to the Director Stock Ownership Association for each director to acquire shares of the Company, and the sale of such shares is in principle prohibited until each director resigns from office in order to ensure a linkage between the director's remuneration and the Company's stock price.

III. Outline of restricted stock remuneration

Pursuant to the resolution of the 39th Ordinary General Shareholders' Meeting held on March 23, 2022, the Company has introduced a remuneration plan that allots shares of restricted stock to directors (excluding directors who are Audit and Supervisory Committee members and outside directors; hereinafter, these directors are referred to as "Eligible Directors" and the remuneration plan is referred to as the "Plan") for the purpose of incentivizing them to improve the performance and enhance the sustainable corporate value of the Company and promoting further value sharing between directors and shareholders.

The specific details of the allotment of restricted stock to Eligible Directors shall be determined by the Board of Directors based on the title-specific policies on the calculation methods of the amount of remuneration for officers.

Eligible Directors shall receive common shares of the Company that are newly issued or disposed of by the Company in exchange for payment as property contributed in kind of all monetary claims provided to them based on the resolution of the Board of Directors of the Company. The total number of Company common shares permitted to be newly issued or disposed of in this way shall be 40,000 shares per year. (However, if a stock split or reverse stock split of Company common shares is carried out with the effective date falling on or after the day on which the Plan is approved and unavoidable circumstances arise as a result that necessitate an adjustment to the total number, the total number may be adjusted as necessary to a reasonable extent in accordance with the stock split ratio or the reverse stock split ratio as applicable.)

The paid-in amount per share shall be the closing price of the Company's common shares on the Tokyo Stock Exchange on the business day immediately preceding the date of the resolution made by the Board of Directors of the Company pertaining to the issuance or disposition of shares to be allotted under the Plan. (If they were not traded on that day, then the closing price of the immediately preceding day they were traded.)

Transfer of any shares granted under the Plan shall be restricted during the period from the date of delivery to the day on which each Eligible Director loses his or her position as director or other positions as determined by the Board of Directors of the Company (hereinafter, the "Restricted Period"). The transfer restriction shall be lifted upon the expiration of the Restricted Period or when each Eligible Director resigns from office for a reason determined by the Board of Directors to be legitimate or another reason such as death. In principle, when an Eligible Director resigns from the director position or leaves the Company before the expiration of the Restricted Period, shares that have been allotted to him or her shall be reacquired by the Company without consideration.

- Persons Eligible for Stock Options

Supplementary Explanation for Applicable Items

–

Director Remuneration

- Disclosure Status of Remuneration for Individual Directors

- Not disclosed

Supplementary Explanation for Applicable Items

Not applicable

- Policy for Determining Remuneration Amounts and Calculation Methods

- Established

Disclosure of Policy for Determining Remuneration Amounts and Calculation Methods

I. Policies for determining the amount of remuneration for officers and the calculation methods and methods of determining such policies

A. Remuneration for directors (excluding directors who are Audit and Supervisory Committee members)

Remuneration for directors consists of fixed remuneration, performance-linked remuneration that reflects single-year performance, and restricted stock remuneration, the purpose of which is to incentivize Eligible Directors to contribute to medium to long-term corporate value enhancement and to strengthen management from the perspective of shareholders.

Specific payment amounts and proportions are determined by the Board of Directors within the total amount approved at the General Shareholders' Meeting and based on the title-specific policies on the calculation methods of the remuneration amount for officers. As for the timing of payments, fixed remuneration is paid on a monthly basis, performance-linked remuneration is paid annually in an amount calculated based on the degree of achievement of the consolidated net sales targets for each fiscal year, and for restricted stock remuneration, the specific timing of when it is granted to Eligible Directors is determined by the Board of Directors.

Under the stock-acquisition type remuneration plan, Eligible Directors are required to contribute a certain percentage of their fixed remuneration amount to the Director Stock Ownership Association for the purpose of further raising their motivation to contribute to long-term corporate value enhancement.

Remuneration for outside directors consists only of a monthly fixed monetary remuneration.

B. Amount of remuneration for directors who are Audit and Supervisory Committee members

Remuneration for directors who are Audit and Supervisory Committee members consists only of a monthly fixed monetary remuneration, and specific amounts are determined by the Audit and Supervisory Committee through consultation among its members.

C. General Shareholders' Meeting resolutions on remuneration for directors

a. Resolution on fixed remuneration for directors (excluding directors who are Audit and Supervisory Committee members)

The upper limit of remuneration is 170 million yen per year (not including employee salaries received by directors who double as employees), which was approved at the 39th Ordinary General Shareholders' Meeting held on March 23, 2022. The number of directors at the close of the General Shareholders' Meeting was three.

b. Resolution on performance-based remuneration for directors (excluding directors who are Audit and Supervisory Committee members)

The upper limit of remuneration is 20 million yen per year (subject to a lower limit of zero), which was approved at the 39th Ordinary General Shareholders' Meeting held on March 23, 2022. The number of directors at the close of the General Shareholders' Meeting was three.

c. Resolution on restricted stock remuneration (excluding directors who are Audit and Supervisory Committee members and outside directors)

The maximum total amount of monetary remuneration claims used for the allotment of restricted stock is 50 million yen per year, which was approved at the 39th Ordinary General Shareholders' Meeting held on March 23, 2022. The number of directors at the close of the General Shareholders' Meeting was three.

d. Resolution on remuneration for directors who are Audit and Supervisory Committee members

The upper limit of remuneration is 40 million yen per year, which was approved at the 39th Ordinary General Shareholders' Meeting held on March 23, 2022. The number of directors who were Audit and Supervisory Committee members at the close of the General Shareholders' Meeting was four.

II. Title-specific policies on calculation methods of the amount of remuneration for officers

The job responsibilities of directors (excluding directors who are Audit and Supervisory Committee members) are not lower than those of employees. Likewise, remuneration for such directors is not lower than that of employees. The job responsibility index for directors has been determined based on remuneration for employees in consideration of the weight of their titles and concurrent positions. The amount of remuneration for each employee, including fixed remuneration, performance-linked remuneration, and restricted stock remuneration, is determined by the Board of Directors itself without delegating the determination authority to others.

The amount of remuneration for each director who is an Audit and Supervisory Committee member is determined by the Audit and Supervisory Committee through consultation among its members.

III. Name of the person or body that has the authority to determine the amount of remuneration for officers, its calculation methods, a specific description of the authority, and the scope of discretion

The Board of Directors has the authority to determine the policies that establish the amount of remuneration for directors (excluding directors who are Audit and Supervisory Committee members) or its calculation methods. The Board of Directors shall determine its specific authority and scope of discretion in comprehensive consideration of each director's job responsibilities, among other factors, within the upper limit of remuneration approved at the General Shareholders' Meeting.

The Audit and Supervisory Committee has the authority to establish policies that determine the amount of remuneration for directors who are Audit and Supervisory Committee members or its calculation methods. The Audit and Supervisory Committee shall determine its specific authority and scope of discretion through consultation among its members within the upper limit of remuneration approved at the General Shareholders' Meeting.

Support System for Outside Directors

All outside directors of the Company are directors who are Audit and Supervisory Committee members. Full-time Audit and Supervisory Committee members are responsible for the operation of the Audit and Supervisory Committee. There are no employees who are responsible for assisting outside directors on a full-time basis. Outside directors are provided with materials for board meetings as well as any necessary explanations in advance by the Business Planning Department, which serves as the secretariat.

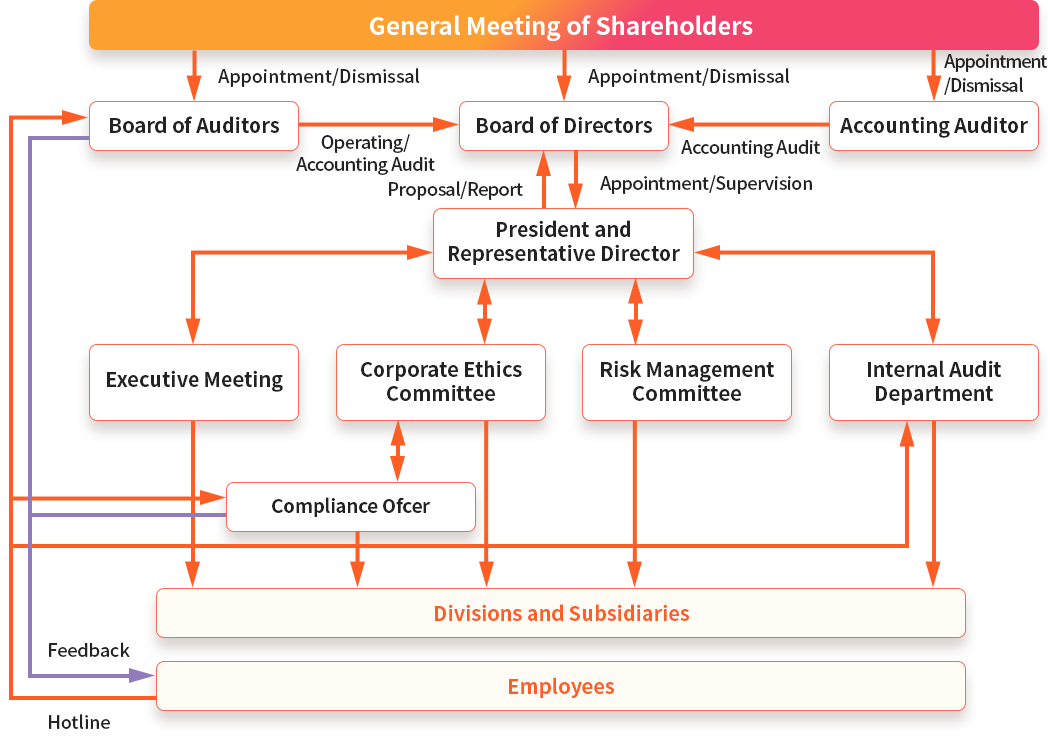

2. Matters concerning Functions of Business Execution, Auditing and Supervision, Nomination, and Remuneration Decisions (Overview of Current Corporate Governance System)

In order to further strengthen its corporate governance system, the Company has transitioned from a company with an Audit and Supervisory Board to a company with an Audit and Supervisory Committee pursuant to the resolution passed at the 39th Ordinary General Shareholders' Meeting held on March 23, 2022.

Under this corporate structure, multiple outside directors who are Audit and Supervisory Committee members have voting rights on the Board of Directors, and this is expected to strengthen audits and audit functions and contribute to the continuous improvement of the Company's corporate value.

Specific descriptions of each governing body are as follows:

As of the date of the submission of this report, the Board of Directors consists of four directors (excluding directors who are Audit and Supervisory Committee members) and four directors who are Audit and Supervisory Committee members. The Board holds ordinary meetings on a monthly basis in principle and extraordinary meetings as necessary. Based on the Board of Directors Regulations, the Board determines basic management policies and important management matters while also making important management decisions, including monitoring the progress status of business measures and supervising the execution of duties by the directors. While directors of the Company (excluding directors who are Audit and Supervisory Committee members) are responsible for both supervision and business execution, the Company introduced a non-director executive officer system in July 2013 in order to further improve the efficiency of business execution. In addition, directors of the Company are managing and supervising decision-making and business operations within the Group by concurrently serving as officers of its subsidiaries. The Board of Directors is chaired by President Haruhisa Sakurai. The other board members are Senior Managing Director (with Representative Authority) Norihiko Shibayama, Managing Director Junko Tochigi, Director Masanori Hayashi, Independent Director (Full-time Audit and Supervisory Committee Member) Kazutoshi Sato, Independent Director (Audit and Supervisory Committee Member) Haruo Sasaki, Outside Director (Audit and Supervisory Committee Member) Katsutoshi Fukami, and Independent Director (Audit and Supervisory Committee Member) Kazuya Shimamura

As of the date of the submission of this report, the Audit and Supervisory Committee consists of four directors who are Audit and Supervisory Committee members (including three independent directors and one outside director). The Company ensures that necessary information is promptly supplied to the Committee in order to guarantee the effectiveness of the audits conducted by its members. The Audit and Supervisory Committee holds meetings on a monthly basis in principle to exchange opinions on the legal compliance and appropriateness of internal control and business execution. Directors who are Audit and Supervisory Committee members work to improve the effectiveness of their audits by participating in the deliberations and resolutions on the agenda for the meetings of the Board of Directors and receiving reports on business execution status. The Committee also exchanges information closely with the internal audit department, with which it coordinates in monitoring the development and operation status of the Company's internal control system. The Audit and Supervisory Committee is chaired by Independent Director (Full-time Audit and Supervisory Committee Member) Kazutoshi Sato. The other board members are Independent Director (Audit and Supervisory Committee Member) Haruo Sasaki, Outside Director (Audit and Supervisory Committee Member) Katsutoshi Fukami, and Independent Director (Audit and Supervisory Committee Member) Kazuya Shimamura.

The Executive Meeting, which consists of full-time officers, executive officers, and general managers of business and other departments and offices, holds meetings on a monthly basis in principle to promptly deliberate on important business matters and to share information. The Executive Meeting of the Company is chaired by President Haruhisa Sakurai. The other members are Senior Managing Director (with Representative Authority) Norihiko Shibayama, Managing Director Junko Tochigi, Director Masanori Hayashi, Independent Director (Full-time Audit and Supervisory Committee Member) Kazutoshi Sato, executive officers, and general managers of business and other departments and offices.

The Company has established a Corporate Ethics Committee based on its Corporate Ethics Regulations. The Committee consists of full-time officers, executive officers, and general managers of business and other departments and offices and is chaired by the President. In addition, directors who are Audit and Supervisory Committee members are permitted to attend the meetings of the Committee to state their opinions. The Committee audits the execution of duties by officers and employees to ensure that they always act in compliance with laws and regulations as well as social ethics. The chief compliance officer reports directly to the Corporate Ethics Committee, which monitors the execution of duties by officers and employees and provides appropriate guidance and recommendations for improvement.

As part of its risk management system, the Company has established a Risk Management Committee, which consists of full-time officers, executive officers, and general managers of business and other departments and offices. The Committee is chaired by the President. In addition, directors who are Audit and Supervisory Committee members and officers and general managers of the departments/offices of group companies are permitted to attend the meetings of the Committee to state their opinions on promoting organization-wide risk management. Any matters concerning comprehensive risk management are submitted as necessary to the Board of Directors for deliberation.

The Company has concluded liability limitation agreements with directors who are not executive directors pursuant to Article 427, paragraph (1) of the Companies Act to limit liability for damages under Article 423, paragraph (1) of that Act and subject to the minimum liability amount provided for in Article 425, paragraph (1) of the Act. Such limitation shall be in effect only for cases where the outside directors in question are without knowledge of any gross negligence with respect to the execution of their duties giving rise to such liability.

The Company has entered into the officer liability insurance contract prescribed in Article 430-3, paragraph (1) of the Companies Act with an insurance company under which directors of the Company and officers of its subsidiaries are insured persons. Insurance premiums are fully borne by the Company. This insurance contract compensates for any damage to the directors and officers who are insured persons that may arise from any liability owed by them in relation to the execution of their duties or any claims made against them in relation to the pursuit of such liability. However, damage to the insured persons themselves is excluded from the scope of compensation if they have intentionally engaged in misconduct.

The Business Planning Department is responsible for the management of subsidiaries and receives reports from and provides guidance and support to the subsidiaries based on the Subsidiaries and Affiliates Management Regulations. In addition, executive directors of the Company regularly supervise the business management status of subsidiaries and receive reports from them regarding financial conditions, including financial performance, management issues, and the progress status of measures, which are shared at regular meetings. Execution of major business matters by subsidiaries is subject to the approval of the Company.

3. Reasons for the Adoption of the Current Corporate Governance System

The Company has adopted the corporate structure of a company with an Audit and Supervisory Committee based on the determination that Audit and Supervisory Committee members can improve the effectiveness of its management audit functions under this corporate structure, including by having multiple outside directors with voting rights on the Board of Directors.

Pinch out to enlarge.